The popular limited liability company (LLC) that can be registered across the world can be registered as a limited liability partnership (LLP) or as a private limited company in India. Through a LLP in India, the investors will benefit from limited liability, in the sense that they will be held accountable for the company’s debts only in the extent to which they have contributed to the company’s capital.

When starting a business in India registered as a LLP, the registration procedure is performed following the regulations prescribed by the Limited Liability Partnership Act 2008 and the Companies Act 1956. Our team of specialists in company formation in India can offer assistance on the main procedures deriving from the above mentioned acts, as well as on the documents that are to be submitted with the local institutions.

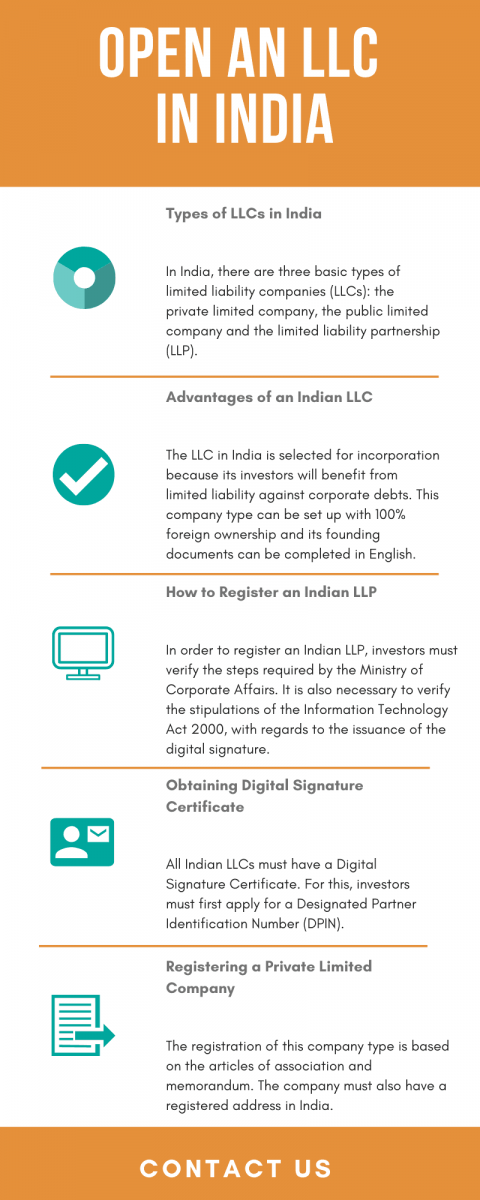

What are the advantages of an Indian LLC?

The Indian LLC is a type of company that is very popular amongst foreign investors interested in opening a company in India. This structure provides a set of advantages, which are presented in the list below and which can also be detailed by our team of consultants in company registration in India. The basic characteristics are the following:

- ownership – the company can be formed with 100% foreign ownership, as there are no restrictions in this sense;

- liability – the investors are protected against company debts, as the company is a separate legal entity;

- shareholding structure – the company needs only two shareholders for its incorporation;

- company documents – the company’s documents can be prepared in English, this being an important advantage for foreign businessmen;

- capital – it requires a small capital compared to other business forms.

With regards to the company’s shareholding structure, it is important to know that the shares of an Indian LLC can be owned by natural persons and legal entities, local of foreigners. A mix of foreign companies and foreign natural persons is also allowed when referring to the company’s shares.

If you want to register the name of your company as an Indian trademark, you can rely on our agents.

Types of LLPs in India

Under the regulations prescribed for commercial companies in India, the limited liability company can be set up as one of the following business forms: private limited company, limited liability partnership and public limited company. The procedure on how to form a company in India for the above mentioned types of legal entities prescribes different regulations on the number of shareholders the company may have.

In a private limited company, the legal entity may be formed with a maximum of 50 shareholders (and minimum 2), while for a public limited company, there are no restrictions related to the number of participants (however, the minimum number is established at seven).

Foreign businessmen must know that from the above mentioned legal entities, thepreferred business form is the private limited company, for both local and foreign businessmen and our team of agents in company registration in India can offer in-depth information on the main requirements applicable in this case.

Required documents for registering an Indian LLP

In order to open a company in India registered as a LLP, the company’s representatives will need to deposit a set of documents and the minimum requirements established in the sense refer to the following: the certificate stating the company’s name, the company’s founding papers and the power of attorney.

The registration is handled by the Ministry of Corporate Affairs, which prescribes the legal procedures that are required in this sense. For example, businessmen will need to obtain a Digital Signature Certificate, under the regulations of the Information Technology Act 2000. The certificate is necessary for submitting various electronic documents and it can only be used by the applicant who received the respective document.

What are the steps in registering an Indian LLP?

As mentioned above, the first steps for opening a company in India as a limited liability partnership are concluded through the Ministry of Corporate Affairs. In order to obtain the Digital Signature Certificate, the owner of the company first has to apply for a Designated Partner Identification Number (DPIN), a procedure which can be completed on the website of the institution. The following will apply as well:

- the DPIN is obtained by filling theForm DIR-3, which is also used for the issuance of the Director Identification Number (DIN);

- once the company received its Digital Signature Certificate (DSC), the company’s representatives need to register the DSC on the portal of the Ministry of Corporate Affairs;

- in order to benefit from the online services available for an Indian LLP, the investor is then required to register as a user of the portal;

- further on, the investor can register the company’s name, by completing a specific form;

- then, the investors can draft the company’s statutory documents, which have to be registered with the Ministry of Corporate Affairs in a period of 30 days since the documents were signed.

With regards to the regulations referring to the Indian LLP, it is necessary to know that it is possible to convert an existing business into this company type. However, this is available only for businesses operating as partnerships or as private companies. This can also be done if the business is registered as an unlisted public company.

In order to change the current legal entity of an Indian business into a LLP, various documents have to be submitted with the Ministry of Corporate Affairs. In the case of businesses operating as partnerships, the applicants must complete the Form 17 (Application and Statement for the Conversion of a Firm into LLP) and the Form 2 (Incorporation Document and Subscriber’s Statement).

Those who want to convert a private company or an unlisted public company into a LLP in India will also use the Form 2. However, they will have to complete a second document as well, represented by the Form 18 (Application and Statement for the Conversion of a Private Company/Unlisted Public Company into LLP).

What are the tax obligations of an Indian LLP?

With regards to the taxation of an Indian LLP, it is important to know that the local legislation treats this company type as a separate legal entity from its owners. This type of company is legally required to be registered for taxation purposes with the Income Tax Department, which also supervises the procedure for VAT registration in India. The following taxes are applicable to this structure:

- the income tax to which an Indian LLP is liable to is of 30%;

- there is a surcharge on the income tax applicable at the rate of 12% if the company’s income is above INR 10 million;

- in India, there is also a health and education surcharge, imposed at a rate of 4%;

- the LLP can also be charged with the minimum alternate tax, applicable at a rate of 18,5% on the total income of the company;

- the LLPs in India that are required to perform an audit must pay their taxes using the online platform of the Income Tax Department, as required by the Section 44AB of the Income Tax 1961.

We can offer updated information on the taxation of a limited liability company in India in 2024.

Can an investor register a foreign LLP in India?

Yes, the applicable legislation stipulates that foreign businessmen are allowed to register a foreign LLP in this country. This is done by filling the Form 27 – Registration of Particulars by Foreign Limited Liability Partnership. In this case, it is also compulsory to obtain a Digital Signature Certificate, as the electronic form needs to have the company’s representative signature. However, a foreign LLP in India is not required to have a DIN or a DPIN; our team of specialists in company registration in India can provide more information on the registration of a foreign LLP.

If you want to open an Indian limited liability company in 2024, our agents are at your service. You can rely on us no matter the types of activities you want to undertake under this business form.

The limited liability company is one of the simplest forms of starting a business in India in 2024 because it offers limited responsibility to its shareholders and is available for foreign investors who want to have their enterprises in India.

How can one start a private limited company in India in 2024?

For 2024, the procedure on how to form a company in India that operates as a private limited company is basically the same with the one available when opening an Indian LLP. Thus, all the above mentioned procedures are also applicable in this case; however, the private limited company in India is founded based on other types of incorporation documents, namely the memorandum of association and articles of association. The application for opening this type of company must contain, besides the company’s statutory documents, the below mentioned:

| the company’s registered address | the proof on this matter can be done through utility bills |

| the rental agreement for the company’s office | this is necessary as long as the company operates in a rented location |

| the director’s consent | a document through which the person who is appointed as a company director provides his or her consent to act in this function (by completing the Form DIR-2) |

| certified copies | necessary to attest the identity of the company’s founders |

Why register an Indian PLC in 2024?

The Indian private limited company is a common business form used in India at the level of 2024. One of the advantages of starting a company in India through this structure is that its founders will be responsible for the company’s debts only to the extent of their participation at the company’s capital.

The company represents a separate legal entity and it is regulated under the provisions of the Companies Act 2015. In order to register it, investors will have to apply to the Registrar of Companies in India. It can also be used as a means of raising capital as this structure allows external sources of funding.

For its registration, it is necessary to have at least two founders; a part of the regulations prescribed by the Companies Incorporation Rules 2014 will apply. This type of company must appoint minimum two directors and a maximum of 15. When referring to the company’s directors, it is necessary to know that at least one of the directors has to be Indian citizen or at least a person who has obtained the Indian residency.

The owners of the company can be both natural persons or legal entities, who are residents in India or foreigners. Just like in the case of an Indian LLP, the investors will also need to select a company name, a procedure that is supervised by the Ministry of Corporate Affairs.

How to select name for an LLC in India?

The company’s name has to follow the legal requirements stipulated by the Companies Act 2015. In many states, it’s prohibited for two separate business entities to establish an LLC with the same name, regardless of their location. Additionally, certain states impose restrictions on specific words in business names, such as “bank.” It’s recommended to conduct a search with the help of our company formation experts in India to verify the availability of your proposed LLC name before proceeding with the necessary paperwork.

Furthermore, researching similar local businesses for identical or similar names is advisable to avoid confusion and potential trademark issues. Securing an available domain name aligned with your business name is also worth considering. If you’ve chosen an available LLC name but don’t intend to immediately register your business documents, you may opt to reserve the name until LLC formation. Most states offer name reservation options for a designated period upon submission of a form and payment of a reservation fee, with varying policies for renewal and charges.

Upon registration, investors can propose two trading names; if they are rejected, the company’s representatives can apply for other proposed company names. The approval on the company’s name can be obtained in a period of 1 or 2 business days. Investors opening a company in India should know that the company’s name can be modified due to a set of reasons and that they are not legally required to maintain the same name that was registered during the incorporation procedure. If this decision was taken, the new company name has to be reserved on the online platform of the Ministry of Corporate Affairs.

If the new name is approved, the company’s representatives have to file a resolution for the alteration of the company’s statutory documents, which will contain the new company name. After this, it is also necessary to complete the eForm INC-24 (Application for Approval of Central Government for Change of Name). You can also watch our video below:

How many companies operate in India?

The Indian business environment is a developed one; since it has one of the largest populations at a global level, the country is also characterized by a large number of companies. The following data is available regarding this subject:

- As of January 2023, India had a total of more than 1.51 million registered companies;

- Of these, more than 1.5 million were companies limited by shares;

- Additionally, there were 296 unlimited liability companies among the registered entities in the country in 2023;

- at the level of June 2018, the highest number of enterprises was registered in the region of Maharashtra, accounting for 353,556 companies;

- the second most important region is Delhi, where there were 322,044 companies;

- the third most important region is the West Bengal, accounting for 197,823 companies;

- from all the companies operating in this country, only 66% of them were active in June 2018;

- a number of 38,858 companies were in the process of being closed down, while 6,117 were in the process of liquidation.

In 2024, the number of banks in India is made of 21 private banks and 12 nationals ones.

Setting up a company in India vs. in Mauritius

Investors interested in extending their businesses in India, may find useful this short comparison on setting up a company in India vs. in Mauritius.

Quick facts about opening a company in India

- Time frame for the incorporation: approx. 8 weeks;

- Minimum share capital for LLC: 1,160 USD paid on incorporation;

- Corporate tax rate: 22% standard rate.

Quick facts about opening a company in Mauritius

- Time frame for the incorporation: 3 weeks

- Minimum share capital for Global Business Company (GBC): 1 USD;

- Standard corporate tax rate: 15%.

In case you need more details about the aspects of setting up a company in Mauritius, our partners from CompanyFormationMauritius.com are at your disposal.

The registration procedure is comprised of other compulsory steps and it is advisable to contact our team of consultants in company registration in India for more information on this matter. Our representatives can offer tax consultancy services for Indian limited liability companies; investors can also receive legal representation on the registration requirements imposed by the local tax institutions.